Here’s a breakdown of the QuickBooks Self-Employed plans to help you decide. Which version of QuickBooks Self-Employed should I get? It has essential features that make it perfectly suited for users with less time to spend on accounting, as well as a simple and intuitive user interface.Īpart from the basics, such as keeping track of transactions and sending invoices to customers, QBSE comes with powerful features that help you categorize business income and create expense reports, snap pictures of bills, and track mileage for Schedule C reports with ease. This is the least expensive version of QuickBooks, starting at just $7.50 per month. QuickBooks Self-EmployedĪs the name indicates, QBSE is a tool aimed at self-employed individuals, or entrepreneurs with simple business structures, with no employees or contractors, such as realtors, freelancers, Uber and Lyft drivers, and independent consultants. It offers the cheapest plan for the program that’s appropriate for those with no workers or contractors. $180 per month ($90 per month for a 3-month package)ĭid you know? QuickBooks has a version just for those who are self-employed.

QUICKBOOKS PRO PLUS

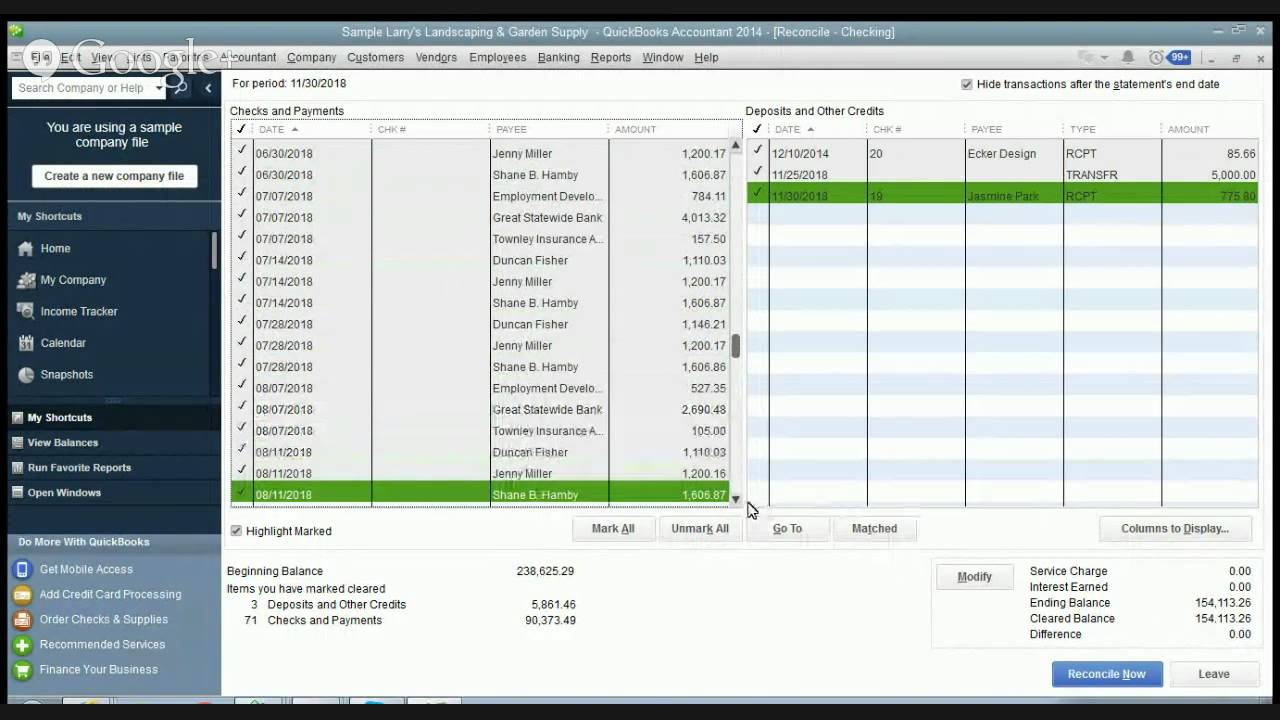

While these features can add plenty of value to businesses of all sizes, they can also be quite overwhelming at first, and involve a significant learning curve for entrepreneurs with no training in accounting. QBO also allows third-party apps and integrations to enhance the capabilities of small businesses. It takes care of basic accounting tasks such as creating and sending invoices, tracking inventory, and recording transactions, along with more advanced reporting and financial management solutions such as accounts payable and receivable, employee records, and tax filings. QBO is a simple yet dynamic tool that provides a host of features and functions that cover every aspect of accounting, bookkeeping and financial reporting at a small or midsize business. Two key options are QuickBooks Online (QBO) and QuickBooks Self-Employed (QBSE). To cater to a wide range of user requirements and situations while not overwhelming small business owners and freelancers, QuickBooks offers different versions of its products with varying functionality and tiered pricing. For more information, see our review of QuickBooks Online. Key takeaway: QuickBooks Online is superior for all business types because it is less expensive and has more features than QuickBooks Pro, the program’s desktop version. This is especially true because QuickBooks’ desktop versions are being steadily phased out, with older versions not receiving any critical security updates since June 2021.

QUICKBOOKS PRO PRO

Unless your business or industry has stringent security and compliance requirements necessitating local data storage, choosing QuickBooks Online over QuickBooks Pro is a no-brainer.

It’s no wonder that Intuit itself pushes customers away from its on-premises solutions. QuickBooks Pro is not only significantly more expensive, but it also lacks the functionality, integrations, flexibility, add-ons and enterprise-grade security features that come with QuickBooks Online.

QUICKBOOKS PRO SOFTWARE

We haven’t covered the desktop software in this guide because QuickBooks Online is the obvious choice for businesses of all sizes.

QUICKBOOKS PRO UPDATE

This article is for small business owners trying to decide what version of QuickBooks to use.ĭespite the popularity of its cloud-based services, QuickBooks continues to update and support QuickBooks Pro, its desktop solution.A version for self-employed individuals is available, called QuickBooks Self-Employed.QuickBooks Online offers several plan options.QuickBooks Online is cheaper and comes with more features than QuickBooks Pro, the desktop version.

0 kommentar(er)

0 kommentar(er)